- Abwicklung aller relevanten Prozesse rund um die Verwaltung Ihrer Kapitalanlagen.

- Schnell, effizient, vollständig digital – browserbasiert in einer modernen, user-zentrierten Applikation.

- Anschauliche Darstellung von Kennzahlen auf Basis von Gesellschaften, Subgesellschaften, Portfolios, Depots und Einzeltiteln.

- Mathematische Bewertungsverfahren für nahezu alle gängigen Asset-Klassen.

- Automatisierung im Bereich der Stammdaten- und Bestandsverwaltung, des Order-Management und der Buchhaltung bis hin zu Risikokontrolle und regulatorischem Meldewesen.

- Entlastung Ihrer IT-Ressourcen durch Nutzung der Fact IT-Infrastruktur

Die First Cloud-Anwendungsfälle für institutionelle Investoren

Bestandsverwaltung und Buchhaltung

- Verwaltung einer Vielzahl unterschiedlicher Asset-Klassen

- Nebenbuch und Hauptbuch

- Unkomplizierte digitale Verwaltung und Abruf aller notwendigen Informationen für alle Kapitalanlagen

Das kann First Cloud

Bestandsverwaltung und Buchhaltung bilden den Kern von First Cloud. Versicherer, Versorgungswerke, Stiftungen, Pensionskassen und andere institutionelle Anleger verwalten so ihre Bestände und erfassen alle damit verbundenen Geschäftsvorgänge. Die Software beherrscht die Bewertung, Bilanzierung und Abbildung aller gängigen Asset-Klassen. Neben klassischen Finanzinstrumenten wie Aktien, Anleihen, Investmentanteilen und Hypotheken gehören dazu auch strukturierte Produkte, Immobilien, Private-Equity-Beteiligungen, derivative Finanzinstrumente und vieles mehr.

Volle Transparenz über alle Bestände

First Cloud basiert auf einem Kapitalanlage-Nebenbuch. Als Basis dienen immer der jeweilige einzelne Bestand und die entsprechenden Geschäftsvorfälle. Diese werden im Rahmen des Verwaltungsprozesses in einzelne Bestandteile zerlegt und anschließend auf Basis eines kundenindividuellen Regelwerks in eine Hauptbuchsicht überführt. Somit ist für den Anwendenden zu jedem Zeitpunkt nachvollziehbar, wie die Werte im System zustande kommen.

Mehr Effizienz im täglichen Geschäft

Anwendende können alle Fragen, die in Zusammenhang mit den von ihnen betreuten Anlagen stehen, unmittelbar und interaktiv aus First Cloud heraus beantworten – komplexe SQL-Befehle, händische Datenbankabfragen oder Programmierkenntnisse sind nicht erforderlich. Damit erleichtert First Cloud das tägliche Geschäft und bietet Ihnen ganz unkompliziert die Möglichkeit, alle relevanten Fragen rund um die Kapitalanlagen schnell, effizient und digital zu beantworten. Die Software First Cloud unterstützt verschiedene Mandanten und Rechnungslegungsarten und ist dabei Multi-GAAP-fähig.

Sprechen Sie mit unserem Experten

Meldewesen

- Gesamtes Kapitalanlagemeldewesen in einer Software

- Geführter, schrittweiser Prozess

- Ausgabe in den amtlich geforderten Formaten

Das kann First Cloud

Die Anforderungen an das Meldewesen institutioneller Investoren seitens der Aufsichtsbehörden auf nationaler und internationaler Ebene sind in den letzten Jahren stark gewachsen und entwickeln sich ständig weiter. First Cloud ermöglicht Ihnen die regelmäßige Erstellung und Abgabe der geforderten Meldungen im Rahmen eines geführten, interaktiven Prozesses. Als Basis dient die Bestandsverwaltung und Führung des Nebenbuchs mit First Cloud.

Maximale Automatisierung der Abläufe

Die in First Cloud hinterlegten Informationen zu den Kapitalanlagen werden automatisiert zusammengetragen, dann die geforderten Werte berechnet und schließlich in die vorgegebenen Berichtsstrukturen überführt. Durch einen geführten Erstellungs- und Freigabeprozess reduziert sich der Aufwand für die Erstellung und Abgabe der Meldungen gegenüber der Bundesbank und der BaFin/EIOPA auf ein Minimum. Gleichzeitig ist eine maximale Nachvollziehbarkeit der Daten bis hinunter zum einzelnen Datensatz gegeben, so dass sich Nachfragen durch behördliche Stellen jederzeit schnell und unkompliziert beantworten lassen.

Sprechen Sie mit unserem Experten

Solvency II

- Berechnung aller Risiken vom Einzeldatensatz bis hinauf zum kompletten Portfolio

- Steuerung von Solvency-Risiken mit dem Solvency-Risiko-Controller

- Flexible Konfiguration von Stresstests

- Geführter Berichterstellungsprozess

- Standardisierte Extraktionsmöglichkeiten für Solvency-Datensammler

Das kann First Cloud

Mit dem Inkrafttreten von Solvency II wurde das europäische Versicherungsaufsichtsrecht grundlegend reformiert. First Cloud unterstützt Kapitalanleger aus dem Versicherungswesen, um die sich daraus ergebenden wesentlichen Anforderungen an das Risikomanagement und die erweiterten Publikationspflichten termingerecht zu erfüllen. Basis für die Berechnung der Kapitalanlage-Risiken ist die Bestandsführung von First Cloud oder eine Einspeisung von Bestandsdaten aus externen Datenquellen.

Vom Einzelsatz zum Gesamtrisiko

First Cloud berechnet alle Rsiken zu den gegebenen Anlagen gemäß den Vorgaben des Standardmodells. In der Anpassung der Software auf den Kunden sind aber auch individuelle Abweichungen vom Standardmodell möglich. Ein solches angepasstes Modell kann dann parallel zum Standardmodell berechnet werden. Die Software geht bei der Risikobewertung von den Einzelsätzen aus und aggregiert diese entsprechend Schritt für Schritt bis zum Gesamtportfolio hoch.

Nutzende können alle Kapitalanlage-Risiken abbilden, unterschiedliche Solvency-Szenarien durchrechnen und auf Wunsch Parameter der Risikoberechnung bis zur kleinsten Ebene beeinflussen. Dies geschieht im Rahmen eines geführten Prozesses, der dem Nutzer den Großteil der Arbeit abnimmt.

Spezielle Szenarien schnell durchrechnen

Die Ausgabe der Berechnungen erfolgt im Rahmen der von der Europäischen Aufsichtsbehörde EIOPA definierten Vorlagen (Quantitative Reporting Templates). Sollten Behörden, wie bspw. die BaFin, einmal zusätzliche Informationen bzw. weitere Stresstests anfordern, können diese als separate Szenarien schnell und unkompliziert mit First Cloud gerechnet, analysiert und berichtet werden.

Außerdem stellt First Cloud standardisierte Schnittstellen für die Ausgabe der Daten an marktgängige Solvency-Datensammler zur Verfügung. Mit all diesen Funktionen nimmt Ihnen First Cloud einen Großteil der bürokratischen Prozesse ab, die mit Solvency II verbunden sind.

Sprechen Sie mit unserem Experten

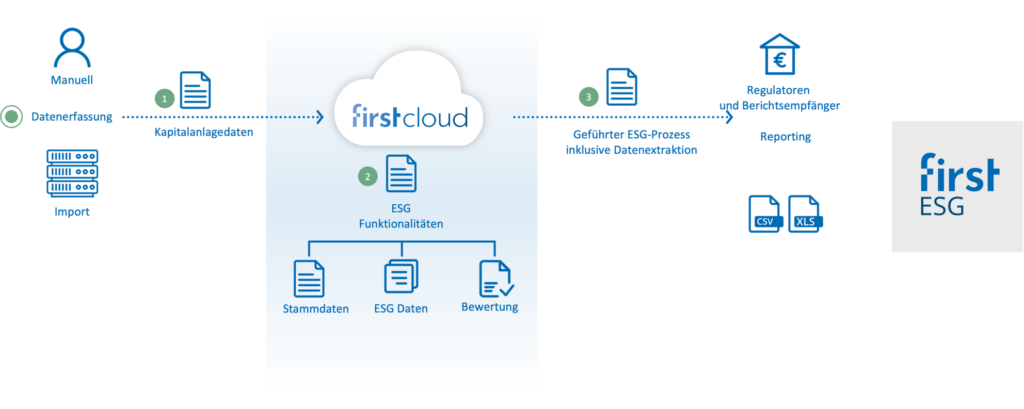

ESG

- Die gesamte Verwaltung von ESG-Informationen für Kapitalanlagen

- Geführter, schrittweiser Prozess vom Import der Daten, über die Berechnung von Kennzahlen bis hin zum Reporting

- Ausgabe in allen gängigen Formaten

Das kann First Cloud

Die Anforderungen an das ESG-Reporting institutioneller Investoren seitens der Aufsichtsbehörden und der Öffentlichkeit sind in den letzten Jahren sehr stark gewachsen und entwickeln sich schnell weiter. First Cloud ermöglicht Ihnen die regelmäßige Erstellung und Abgabe der geforderten Meldungen im Rahmen eines geführten, interaktiven Prozesses. Als Basis dienen die Bestandsverwaltung von First Cloud sowie die ESG-Daten eines oder mehrerer beliebigen Daten-Vendoren.

Maximale Automatisierung der Prozessabläufe

Die in First Cloud hinterlegten ESG-Informationen zu den Kapitalanlagen werden automatisiert zusammengetragen. Dabei stehen dem Anwendenden sowohl die Rohdaten als auch die abgeleiteten Werte zur Verfügung.

In der First Cloud-Bewertung werden auf Basis des Datenhaushaltes die geforderten Kennzahlen berechnet und schließlich in die vorgegebenen Berichte überführt. Dabei ermittelt First Cloud die nachteiligen Nachhaltigkeitsauswirkungen („principal adverse impact“ PAI-Indikatoren) entsprechend der RTS und somit die Table 1-3 Standard-Reportings sowie die Berechnung der Taxonomie-KPIs für die Erstellung des Taxonomie-Reportings für den Anhang X-Meldebogen 2 und Anhang XII-Meldebögen 1-5. First Cloud ermittelt den Attribution Faktor auf Basis der im PCAF-Standard definierten Aggregationsverfahren und berechnet automatisch THG-Emissionen nach PCAF-Regeln, abhängig von den verfügbaren Ausgangsdaten.

Eine maximale Nachvollziehbarkeit der Daten bis hinunter zum einzelnen Datensatz ist gegeben, so dass sich Nachfragen z.B. durch Wirtschaftsprüfer, die Aufsichtsbehörden oder die Öffentlichkeit jederzeit schnell und unkompliziert beantworten lassen.

Sprechen Sie mit unserem Experten

Risiko- und Investmentcontrolling

- Szenarien und Annahmen individuell einstellbar

- Kombination aus Controlling und Solvency II

- Einbeziehung der Liquiditätsplanung

Das kann First Cloud

Mit First Cloud planen und steuern Sie die Risiken Ihrer Anlagen über kurze, mittlere und lange Zeiträume hinweg. Treffen Sie Annahmen, wie sich Währungskurse, Zinsstrukturen, Aktienkurse, Indizes und andere Marktparameter verändern könnten und erfahren Sie, was das für Ihre Anlagen im Ist und in der Zukunft bedeutet.

Von der Micro- zur Makro-Analyse

Betrachten Sie gezielt einzelne Investments oder clustern Sie über Anlagen, Risikoklassen, ESG-Kriterien, Länder, Währungen und ganze Portfolios hinweg. Richten Sie Ihren Blick dabei mühelos vom Kleinen ins Große und vom Großen wieder zurück auf die Detailebene. Ihre Szenarien – auch über lange Zeiträume – sind unkompliziert, verständlich und transparent darstellbar.

Die Software kann sich auf die erfassten Assets und Daten aus der Bestandsverwaltung von First Cloud beziehen oder mit Daten aus Fremdsystemen beliefert werden. Lassen Sie sich so auf Risiken durch Konzentration, Ausfälle oder Marktveränderungen hinweisen. Berücksichtigen Sie bei Ihrem Controlling die Auslastungsgrade von Limiten und analysieren Sie diese mit entsprechenden Visualisierungen.

Vorausschauend die Zukunft planen

Außerdem können Sie bereits terminierte zukünftige Ereignisse in Ihre Planungen einbeziehen – etwa Zuflüsse aus der Versicherungstechnik, aus Zinsen, Dividenden, Tilgungen und den absehbaren Mittelabflüssen beispielsweise durch die Ablaufleistung auszuzahlender Lebensversicherungen. So legen Sie den Grundstein, um die Zukunftsfähigkeit Ihres Unternehmens auch für die kommenden Jahre und Jahrzehnte zu sichern.

Planen Sie gezielt Investition für die Zukunft oder lassen Sie das System dies anhand eines frei definierbaren Regelwerkes für Sie erledigen. Sind bestimmte Kennzahlen wichtig für Ihr Unternehmen, so können Sie automatisiert nach diesen optimieren lassen, etwa indem Sie Reserven heben oder durch gezielte Verkäufe Risiken reduzieren.

Sprechen Sie mit unserem Experten

Frontoffice- und Orderabwicklung

- Erfassung aller relevanten Kauf- und Verkaufsdaten

- Automatisierte Versorgung mit aktuellen Stamm- und Marktdaten

- Geführter revisionssicherer Orderprozess

- Bewertung in Echtzeit

- Kontrolle der Marktgerechtigkeit und der Limite

Das kann First Cloud

Wickeln Sie mit First Cloud den gesamten Orderprozess von Wertpapieren ab, indem Sie Ihre Orders erfassen und für Händler, Makler und Depotbanken im System verwalten. Verfolgen Sie transparent den Orderprozess und die Orderausführung. Die ausgeführten Orderaufträge finden Sie anschließend automatisch in der Bestandsverwaltung und Buchhaltung von First Cloud überführen lassen.

Orderinformationen lassen sich mit First Cloud individuell festlegen oder automatisiert auf der Basis von Ordervorlagen generieren. Die dafür erforderlichen Marktinformationen, wie Kurse, Spreads oder Zinssätze bezieht das System – falls gewünscht – zeitaktuell von Marktdatenlieferanten oder anderen Quellen, die sich dafür mühelos an First Cloud anbinden lassen.

Grundsätzlich werden alle Orders und die dafür erteilten Autorisierungen historisiert und revisionssicher festgehalten. Eine Pre-Trade-Limit-Prüfung nach kundenindividuellen Limiten und deren Auslastungsgrade ist ebenso möglich.

Alle Orders stets im Blick

First Cloud setzt im Orderprozess auf höchste Transparenz: Der Orderstatus kann jederzeit im System abgerufen werden, ebenso wie der aktuelle Handelsbestand. Und dies gilt auch für alle weiteren relevanten Kennzahlen ausgehend vom Einzeltitel bis hinauf zum Depot, zum Portfolio oder der gesamten Gesellschaft. Richten Sie auch hier Ihren Blick mühelos vom Kleinen ins Große und vom Großen wieder zurück auf die Detailebene. Auf Basis dieser Orders und den daraus resultierenden Veränderungen schreibt First Cloud die Bestände Ihrer Kapitalanlagen in der Bestandsverwaltung fort.

Handelsunterstützung für Excel

First Cloud Anwendende profitieren von einem speziellen Add-In, durch das First Cloud die maßgeblichen Informationen für den Handelsvorgang Excel verfügbar macht. Damit deckt First Cloud alle wichtigen Aspekte der Ordererfassung und Orderausführung ab und integriert sie nahtlos in den gesamten umgreifenden Prozess der Kapitalanlageverwaltung.

Sprechen Sie mit unserem Experten

Effiziente Verwaltung von FLV-Portfolien

- Vollständig digitalisierter Prozess

- Homeofficefähig für Ihre Mitarbeitenden und den Treuhänder

- Verzicht auf manuelle Prozesse wie Faxübermittlung dank digitaler Treuhändersignatur

- Direkte Anbindung an die Depotbank

- Hohe Skalierbarkeit für das Angebot einer Vielzahl individueller Fonds und einer großen Zahl von Transaktionen

Das kann First Cloud

So einfach war es noch nie, die Kapitalanlagen einer fondsgebundenen Lebensversicherung zu führen und zu verwalten. First Cloud verbindet die Vertragsverwaltung Ihrer Gesellschaft mit dem gesetzlich vorgeschriebenen Treuhänderprozess und im Anschluss daran mit der ausführenden Depotbank.

Vollständig digitalisiert zum Treuhänder

First Cloud erzeugt auf Basis bereits ermittelter Werte Kauf- bzw. Verkaufsvorschläge oder die Software geht auf Wunsch auf Basis von Sollbeständen, die an First Cloud gemeldet wurden, vor. In diesem Fall werden die Ordervorschläge auf Basis eines Soll-Ist-Abgleichs und der Berücksichtigung von Handelsregeln durch First Cloud ermittelt.

Jeder Ordervorschlag kann, wenn gewünscht, durch den Anwendenden geprüft und in einem geführten Prozess an den Treuhänder übermittelt werden. Erstmals setzt First Cloud dabei auf einen durchgehend digitalisierten Treuhänderprozess mit elektronischer qualifizierter Unterschrift über DocuSign®. Dadurch entfällt das lästige und fehlerträchtige Hantieren mit Ausdrucken oder Fax-Sendungen vollständig.

Automatische Weiterleitung zur Depotbank

Nach der Treuhänderfreigabe werden die Aufträge automatisch an die Depotbank übermittelt. Diese liefert die zugehörigen Bestätigungen und Abrechnungen im Gegenzug voll digital an First Cloud zurück. Sowohl der Weg vom Versicherer über First Cloud und den Treuhänder, als auch der gesamte Rückweg zum Versicherer sind damit vollständig digitalisiert. Das lässt Kosten und Prozessrisiken spürbar sinken, eröffnet Ressourcen für andere wichtige Aufgaben und ermöglicht Wachstum.

Sprechen Sie mit unserem Experten

Multi Gaap-Bilanzierung

- Flexible Anpassung mit mehreren parallelen Rechnungslegungsarten

- Vorgabe von Investor-spezifischen Kontenplänen

- Umbewertung auf Basis von First Cloud oder zugelieferter Daten

- Reporting auf Einzelsatzebene oder Aggregierung

- Extraktion der Daten für die digitale Weiterverarbeitung beim Investor

Das kann First Cloud

First Cloud versteht sich auf die wichtigsten Bewertungs- und Bilanzierungsmethoden, die in den Ländern der westlichen Hemisphäre allgemein anerkannt sind (Generally Accepted Accounting Principles).

Automatische Umbewertung möglich

Ob deutsches Handelsgesetzbuch HGB, britischer Bilanzierungsstandard UK GAAP oder eine andere an die International Financial Reporting Standards IFRS angelegte Bewertungsmethode: First Cloud kann die Daten aus dem Nebenbuch zur Abgabe in die gewünschte Rechnungslegung umbewerten.

Und das gilt auch für Nebenbücher, die nicht mit First Cloud, sondern mit einer Software von Drittanbietern geführt und an First Cloud geliefert werden. Diese Funktionalität ist besonders für Verwaltungsgesellschaften interessant, die für ihre Investoren Abschlüsse in mehreren Rechnungsarten erstellen müssen und dies nicht in der Primärbuchhaltung umsetzen möchten bzw. auf Grund von Restriktionen nicht dort umsetzen können.

Sprechen Sie mit unserem Experten

Die wichtigsten Funktionen

Interface – Schnittstellen – Betriebsmodelle

First Cloud: Ihre Vorteile im Überblick

Wir freuen uns auf Ihre Nachricht

Möchten Sie mehr über unser Produkt erfahren, zusätzliche Informationen erhalten oder einen Termin für eine persönliche Demonstration vereinbaren? Dann zögern Sie nicht, mit uns in Kontakt zu treten – Aleksandar Ivezić steht Ihnen gerne zur Verfügung und beantwortet all Ihre Fragen.

Infocenter / Downloads, Videos

Sie möchten weiterführende Informationen zu First Cloud? Dann schauen Sie sich in unserem Infocenter um und laden sich gewünschte Medien herunter.

Erfahrungsbericht unserers Kunden Union IT-Services – So läuft der Wechsel zu First Cloud

Sie sehen gerade einen Platzhalterinhalt von Vimeo. Um auf den eigentlichen Inhalt zuzugreifen, klicken Sie auf die Schaltfläche unten. Bitte beachten Sie, dass dabei Daten an Drittanbieter weitergegeben werden.

Mehr Informationen

Talanx geht mit First Cloud in der eigenen Cloud-Infrastruktur produktiv.

Talanx hat als erster Kunde First Cloud in der eigenen Infrastruktur implementiert. Das Umstellungsprojekt von First Classic auf First Cloud startete im Januar 2024 und wurde innerhalb von zehn Monaten erfolgreich abgeschlossen. Erfahren Sie alles über die optimale Gestaltung des Umstiegs.

Sie möchten die Umsetzung Ihrer Kapitalanlageverwaltung auslagern? Gerne.

Nutzen Sie für Ihre operativen Aufgaben in der Kapitalanlageverwaltung die beste Kombination aus Expertise, Software und IT: Mit unserem Leistungsangebot BPSaaS.